This post includes affiliate links. This means that if you make a purchase after clicking a link in this post, I might make a small commission at no extra cost to you.

If you’re eager to start investing in the stock market you might be wondering whether to start with Freetrade. Here’s my round up of its key features along with the pros and cons. There’s also a cheeky referral link that will nab you a free share worth up to £200 💸 💸 💸

What is Freetrade?

Freetrade is a commission-free investing app designed to make investing easier and more affordable for beginners. If you’d like to invest but feel intimidated by the stock market, this could be a good place to start.

Freetrade has more than 700,000 customers and claims its goal is to help everyone benefit from wealth creation. A statement on its website says: “We don’t think the investing industry works well for most current and future investors. High commissions and clunky products from traditional stockbrokers can make it complicated for people to start investing. […] That’s why we created Freetrade — to break down barriers and open up stock market investing to everyone, creating a stockbroker you can trust.”

In my opinion, Freetrade is ideal for beginners because it’s so easy to use. You’ll be able to dip your toes in the world of investing without having to pay costly fees or charges.

As I’ll explain in more detail later, it’s possible to get a free share worth up to £200 with the help of this Freetrade referral link.

Is Freetrade safe?

TL;DR: Yes! Freetrade has taken a number of steps to ensure your money is protected.

When weighing up whether a new investing app is legit and safe, I tend to look for two key features:

- Is it authorised and regulated by the Financial Conduct Authority (FCA)? Yes! Freetrade is!

- Are customers’ funds covered by the Financial Services Compensation Scheme (FSCS)? Yes! Your money will be protected.

So what does this stuff actually mean? Well, the Financial Conduct Authority is the UK’s only financial regulator and its job is to protect consumers, protect the financial markets, and ensure financial companies are operating in a way that’s honest and fair. The FCA has authorised Freetrade to provide investment services to clients and to hold clients’ assets.

Wondering what the Financial Services Compensation Scheme (FSCS) does for you? This basically means that if Freetrade was to fail, your money would be safeguarded up to the value of £85,000.

Remember! As with any trading or investing app, your money isn’t protected in the event that it falls in value due to market changes and fluctations. If you buy stocks with an energy company, for example, and that company fails, the money you invested in that company is not protected by the FSCS. This is part and parcel of investing.

How to get started with a Freetrade free share

To entice new members to the platform and help people get started, Freetrade has a referral scheme for new members. If you sign up using this Freetrade referral link, fill in the requested details and top up your account, you’ll receive a free share worth up to £200 a few days later. I’ll also get a free share for referring you.

Here’s a step-by-step breakdown:

- Click this referral link

- Enter your phone number

- You’ll be sent a link to download the Freetrade app. Please don’t download the app until you have followed the instructions above - otherwise you won’t get your free share!

- Once you’ve completed the account setup process, you’ll be asked to complete a W-8BEN form. This will allow you to invest in US stocks (Don’t worry – this isn’t as complicated as it sounds and takes seconds)

- You’ll then be asked to top up your account with a small amount. You must fund your account before the free share will be added

What are the key features?

Here’s a review of Freetrade’s key features:

- Simple investing. Easy to get started and doesn’t take long to familiarise yourself with the platform.

- A choice of accounts. General Investment Account, ISA, SIPP and Freetrade Plus to choose from, you can find an account that works for you

- Fractional shares. This means you can invest in large companies like Amazon or Microsoft even if you’re on a tight budget

- ETFs and investment trusts. Diversify and strengthen your portfolio by investing in a wide selection of sectors

- US and UK stocks. Choose from thousands of stocks in a number of different markets. More to come soon!

- Fast and friendly customer service team. Need help with something? It won’t take long to get answers

How easy is the Freetrade app to use?

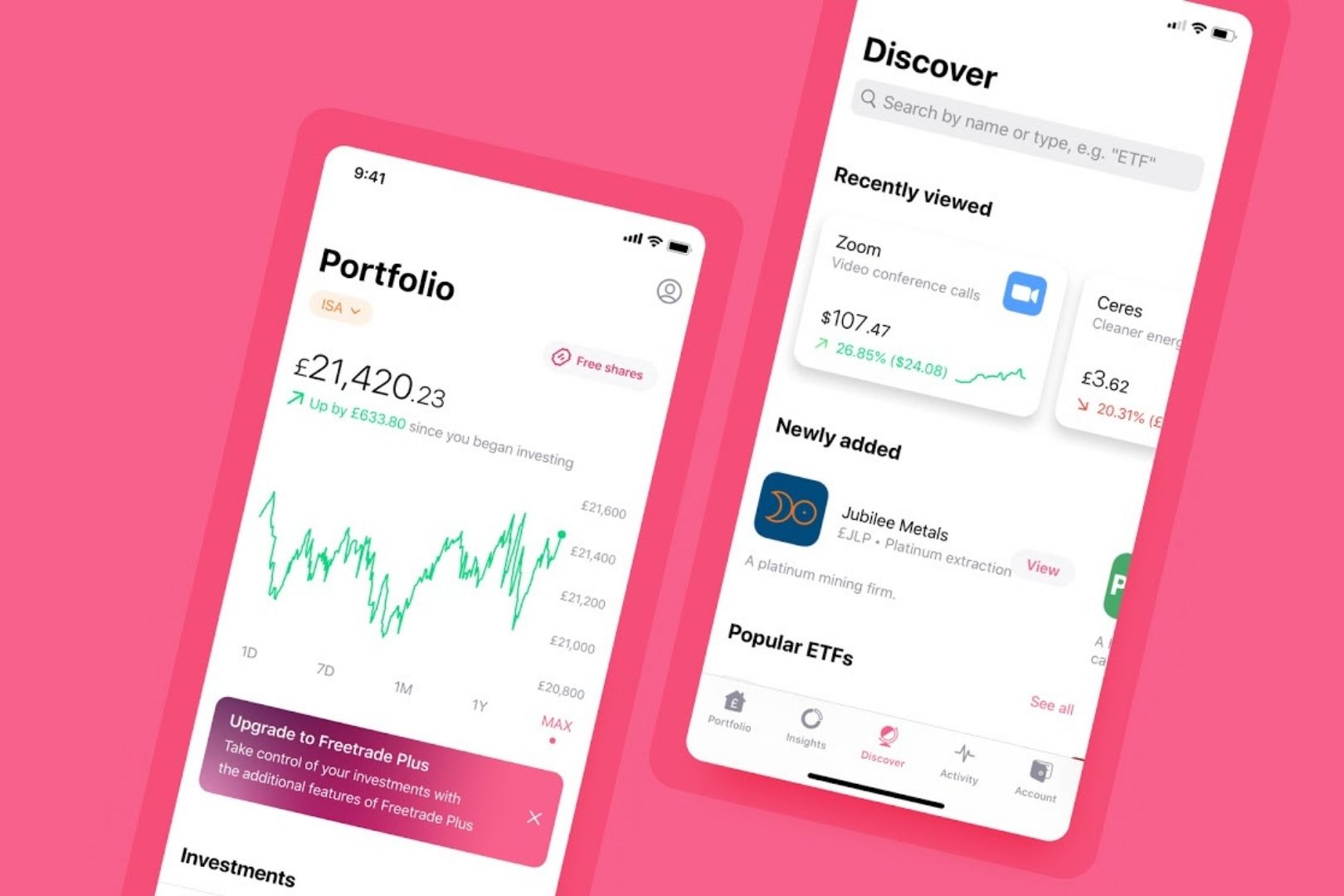

The Freetrade app is really easy to use and it won’t take you long before you can find your way around and make the most of its different features. Another benefit is that although it’s easy to use, in my opinion, it doesn’t gamify investing like other investing apps do. This could help you avoid making potentially poor decisions such as selling your stocks at a loss.

Can you learn how to invest with Freetrade?

Something that makes Freetrade one of the best apps for new investors is this: it makes learning about the stock market a piece of cake.

Freetrade ‘Learn’ review

On its website (rather than the app), Freetrade has a Learn section filled with articles and guides to help you learn about stocks and get started. It’ll explain everything from managing market volatility to how much investment income is tax free.

Join the Freetrade community forum

Check out the Freetrade community forum where you can discuss your stocks with other investors and learn along the way. While I’d suggest taking strangers’ advice and knowledge with a pinch of salt, this can be a great start off point for further reading.

Click here to open your Freetrade account now and grab your free share worth up to £200.

Freetrade Stocks and Shares ISA review

If you’re new to the world of ISAs, here’s a quick review to summarise:

An Individual Savings Account (ISA) is a tax-efficient savings or investment account. With a Cash ISA, you can earn interest on your savings without paying any tax. With an investment/stocks & shares ISA, you can put your money into a wide range of investments (including individual stocks & shares, funds, bonds and ETFs) without paying tax.

Freetrade has a Stocks and Shares ISA with a flat fee of £3/month. It’s worth comparing a few investment ISAs from other providers before making a decision.

Freetrade Plus review

Since Freetrade’s General Investment Account is commission-free, it makes money with a freemium model. If you’d like to upgrade for more features, Freetrade Plus could be worth looking into. For £9.99 a month you’ll get:

- 3% interest on cash up to a max deposit of £4,000

- Limit orders

- Stocks and shares ISA for free (usually £3 a month when you don’t have Freetrade Plus)

- Access to more stocks with your Freetrade Plus membership.

Freetrade SIPP review

Freetrade offers customers a Self Invested Personal Pension (SIPP) too! But it’s important to compare this to any existing pension you have access to before opening a SIPP. For example, if you’re employed, your workplace pension might be more suitable and rewarding.

Here are the benefits of a Freetrade SIPP:

- Tax benefits and annual contributions. Contribute up to 100% of your salary and receive tax relief on contributions up to £40,000 per tax year

- Take control. Decide exactly how your pension is invested, choosing products that reflect your outlook on our changing world

- Consolidate your pensions. Gather multiple pensions in one accessible and low-cost account

- Easy to use platform. Monitor performance and make decisions at the click of a button

Freetrade Pros and Cons

No Freetrade review would be complete without a breakdown of the pros and cons so here’s a quick summary.

Pros

- Affordable and low-commitment investing. I think one of the scariest things about investing is that it can feel so permanent. There’s also this assumption that you need lots of money to get started. With Freetrade, you can create the app, buy a few cheap stocks, and decide whether you’d like to stick with it or not. If you buy £20 of stocks and decide you’d rather invest through a different platform, you can!

- Easy to understand and accessible. Trading and investing apps get some stick from traditional investors but the truth is these apps have successfully filled a gap in the market. Young investors and those new to the stock market have been crying out for easy to understand and accessible ways to invest. It’s broken things down and showing that you don’t have to be an expert to get started. You can buy a few stocks and learn along the way.

- Focused more on investing over trading. Despite what its name suggests, Freetrade is much more focused on long term investing than it is on buying and trading stocks in the short term. I think this encourages more sensible decisions and discourages panic-selling.

- Discover feature. I really like Freetrade’s Discover feature which can be found quite easily on the app. It’s very easy to explore new stock opportunities based on categories or themes. There’s a Green Energy grouping for those looking to make eco-friendly investments. There’s a Popular ETF section for those looking to diversify their portfolios and reduce the impact of market fluctuations. At the moment they even have a Female CEO section for those looking to learn about the companies with women in control. You can also search for stocks by sector such as finance, tech, health, energy and consumer goods. This is a great feature because it can encourage you to branch out and avoid investing in similar companies. The last thing you want is to buy a dozen tech stocks and little else!

Cons

- Limited stock markets to choose from. Freetrade currently only lets you buy stocks from the US and UK markets. While this is likely to suit beginners just fine, those looking to brand out and buy stocks from elsewhere may prefer a different platform.

- More advanced users may get frustrated after a while. While Freetrade is one of the best apps for trading stocks, more experienced investors or those who consider themselves ‘traders’ might want to review a few Freetrade alternatives.

Freetrade alternatives

While Freetrade could be an easy, affordable and accessible way to get started in the stock market, let’s review a few alternatives to consider.

Freetrade vs Moneybox

I recently opened a Moneybox Stocks & Shares Lifetime ISA and while it’s very different to Freetrade (and Trading 212), I love it!

Unlike Freetrade, Moneybox is not commission-free. There are fund costs and you’ll need to pay annual platform fees and monthly subscription fees.

Even though Freetrade’s team say they want to encourage long term investments rather than short term trading, you can use Freetrade to trade if that’s what you want to do. Moneybox is better for those looking to buy stocks on a regular basis and kinda forget about them! I’ve set up a £50 weekly standing order into my Moneybox LISA and I’m not paying too much attention to how my stocks perform. Passive investing, baby!

Moneybox has a selection of different account options so it’s worth exploring them all before you make your decision. Familiarise yourself with the fees!

Freetrade vs Trading 212

I’m gonna go ahead and compare Freetrade to Trading 212 in detail, even though Trading 212 is currently closed to new customers. I’ve got my fingers crossed it’ll get its act together soon but it’s been a few months already so… yeah. That’s embarrassing! As I mentioned earlier, whether you prefer Freetrade or Trading 212 will probably depend on how much of a beginner you are and what you goals are.

Both money apps allow you to buy and sell stocks with no commission. But while Trading 212 makes money through spreads, Freetrade charge a small FX fee (0.45%) on foreign currency stocks. Trading 212 offers cryptocurrency and CFD trading whereas Freetrade focuses on stocks and funds instead.

Here’s a helpful Trading 212 vs Freetrade review I found on Reddit:

Here’s my opinion: I’m a huge fan of Trading 212 and reviewed it last year after making a huge £88 from its referral offer. After signing up for that initial free stock, I began investing my own money into the stock market. (Check out my Trading 212 review to learn more). I went on to build a £4,000 stock portfolio in my Trading 212 Invest account and ISA, but I’m in the process of selling some of these stocks and moving the money into a Moneybox Lifetime ISA instead. Long story short, I’ve realised I’m better suited to the passive investing life rather than picking individual stocks and panicking every time they fall.

I’ve had no problems as a Trading 212 customer but I must admit I’ve felt disappointed with the way it is handling the influx of new members. Back in February, it stopped accepting new members after the GameStop gate drama inspired a rise in the number of people trying to open an account. The pause in account opening was meant to be temporary but 3 months on, it’s still not back to normal. Personally, I think this is pretty poor form and slightly worrying. Why’s it taking them so long?

The good news is that although Trading 212 is unfortunately closed to new members and you can’t currently make the most of its referral scheme (free stock up to £100), you could make twice as much money from the Freetrade referral offer. If you’re a beginner, you might find that Freetrade has advantages you wouldn’t get with Trading 212.

Verdict:

If you want to start investing, money apps can make it so much easier. In my opinion, Freetrade is a fantastic starting point for beginners as it’s affordable, easy to use and relatively low-commitment. Just take things slow and remember not to invest more than you can afford to lose. The stock market is risky and investments can go down as well as up. Don’t invest your house deposit or emergency fund in stocks, no matter how eager you are to try and beat low savings rates. It’s not werf it!!! Also, please remember that none of this should be considered financial advice because I’m just learning as I go too.

If you’ve found this Freetrade review helpful, follow me on Instagram or Twitter to keep up to date with the latest investing apps and trading apps.