Am I Liable for My Partner/ Ex-Partners Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about being responsible for your partner’s or ex-partner’s debt, you’ve come to the right place to find answers.

In this article, we’ll:

- Explain when you might be responsible for such debt.

- Talk about what happens to debts when you separate.

- Cover which debts are typically shared and which are not.

- Give you tips on how to lower your repayments, if possible.

- Guide you on how to deal with debt collectors if they are chasing you.

Every month, more than 12,000 people visit this site for advice on debt matters, so you’re not alone in your worry.

We know it can be scary to think about debt, especially when it’s not even your own. We’ve walked in your shoes, and now we’re here to help you.

Are you liable for your ex-partner’s debt?

As mentioned, if you have joint debts with your ex, you’re typically both liable to repay the full amount. In short, if your ex-partner won’t or can’t pay their share, the lender could ask you to make the payments!

That said, some debts are tied to one person alone and if it’s your ex’s debt, you won’t be liable at all.

So, in short, you should find out what debts you have and if any of them fall under ‘joint liability’.

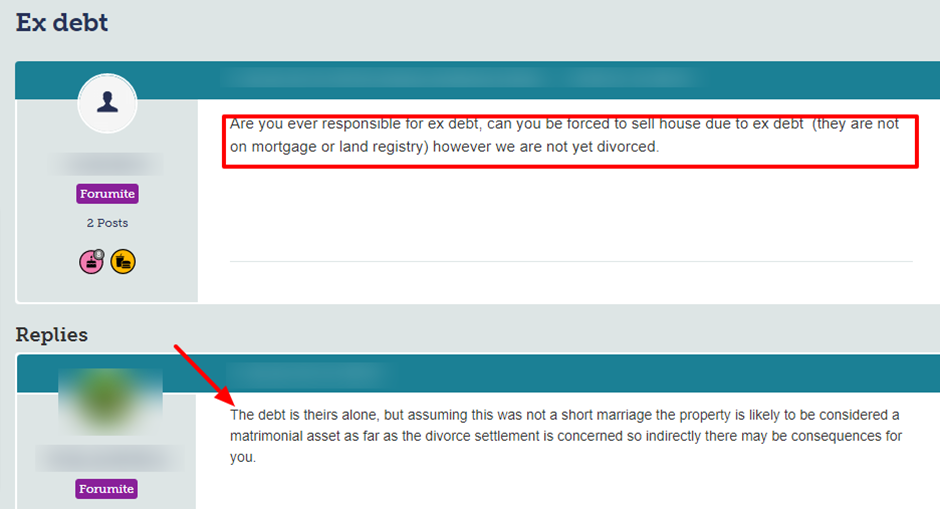

Check out what one person posted on a popular online forum about an ex-partner’s debt and whether they are liable:

Source: Moneysavingexpert

What happens to debts when you separate?

A divorce or separation is often a stressful time for all concerned. What’s more, it could mean your financial circumstances are affected too. Especially when you hold joint bank accounts, loans and other financial agreements you entered into jointly.

It basically means you have joint liability so if your partner or ex-partner defaults on a debt, you’d be liable. You may even have to repay the full debt!

If you’re struggling with your finances following a separation or divorce, you should prioritise paying for essential things. Then focus on whatever debts need sorting out.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What debts are typically shared?

There are various debts which could fall under joint liability. It means both you and your ex-partner are responsible for repaying the full amount. Many people think they are only ‘liable’ for their share of the debt which is not the case!

If one person defaults on a debt, the liability falls on the other person. It’s referred to as ‘joint and several liabilities’.

I’ve listed the type of debts that typically fall into this category below:

- Tenancy agreements and mortgages were taken out jointly

- Bank accounts

- Overdrafts

- Bills that have both you and your partner’s names on them

- Catalogue debts for accounts opened jointly

There are exceptions though. For instance, you could be liable for a council tax bill even if the account was in your ex-partner’s name. This would apply if you were living at the address with your ex over a period of time.

What debts are not shared?

Any debt that’s solely in one person’s name isn’t ‘shared’ provided the other person didn’t act as guarantor.

If your ex-partner has credit cards in their name, you won’t be liable for any debts they ran up on their accounts.

On the other hand, if your ex-partner added you as an additional cardholder, you won’t be liable for the outstanding on the account. Conversely, if you added your ex-partner to your credit card as an additional cardholder, you’d be liable for the debt!

What happens when we are married and divorced?

Being married to someone doesn’t automatically mean you are liable for an ex’s debt when you separate or divorce.

However, your assets and debts could be divided between you when you divorce. It’s also worth noting that if you took out joint credit cards, the financial link for say a mortgage or loan shows up on your credit report.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do I disassociate my ex financially?

Disassociating financially from an ex-partner isn’t complicated. You can have them removed from your report by contacting the credit reference agencies. They will manually remove all financial links you had with your ex-partner.

What can you do if your ex owes you money?

If your ex-partner owes you any money, the first thing to do is contact a mediation service to try and resolve things. It’s a more cost-effective way to sort things out than taking out court action.

If mediation fails, you can then decide whether to start court proceedings against your ex. But you should bear in mind that you’d need to prove that your ex-partner agreed to pay you back!

What’s the best way to deal with shared debt?

When you separate or divorce and have shared debts with your partner, you could:

- Discuss the situation with your ex with the end goal being to agree amicably on how to deal with the debts. If you agree to an informal solution, it means the debts are split between you both. You must let the creditors know which of you is accepting liability for the debt

- Contact your creditors if your ex doesn’t agree to an informal solution or is being awkward. You’d be liable for the debt if creditors aren’t able to contact your ex-partner